EUROVAT-ASISTENCE is a company providing comprehensive tax services not only for transport businesses but also for other companies operating across Europe. We specialize in VAT refunds, fuel excise duty reimbursements, and tax compliance management for international freight and passenger transport. With our extensive experience, in-depth expertise, and efficient collaboration system, we guarantee fast, accurate, and hassle-free tax processes.

Our Vision

We aim to be a reliable tax partner for all businesses with tax obligations abroad, freeing them from unnecessary administrative burdens. We strive for a sustainable business approach based on innovative electronic systems and methods that ensure speed, efficiency, and cost optimization for our clients.- Future-oriented – We invest in automation and digital solutions that streamline administrative tasks.

- Continuous improvement – We monitor legislative changes, develop our own tools, and provide state-of-the-art tax solutions.

- Long-term collaboration – We enable our clients to focus on their business while we take care of their tax obligations.

Our Values – PRESTO, the Formula for a Successful Partnership

- Professionalism – Expertise backed by membership in the Chamber of Tax Advisers of the Czech Republic.

- Reliability – We meet deadlines, ensure full legal compliance, and provide clear information to our clients.

- Efficiency – Modern technologies and digitalization for maximum accuracy.

- Speed – Efficient processing of tax claims and swift VAT refunds.

- Transparency – Fair terms, no hidden fees, and commission only on successfully approved amounts.

- Optimization for everyone – Tailor-made solutions for small transport companies as well as large international logistics firms.

How we work

A Simple and Efficient Process

📜 1. Contract Signing

We establish our cooperation and provide a comprehensive service package.

📂 2. Document Submission

You can send us documents electronically via cloud storage, by mail, or via courier.

⚙️ 3. Document Processing

Our specialists prepare all necessary paperwork and conduct thorough checks.

📨 4. Submission to Tax Authorities

We file applications in compliance with each country’s legislative requirements.

✅ 5. Approval of Amounts

Once processed, tax authorities approve the VAT refund or other tax benefits.

💶 6. Payment to the Client

Approved amounts are transferred directly to your account, with no unnecessary upfront fees.

📞 7. Ongoing Support

Our tax experts are available for consultations and issue resolution, with 24/7 access to our client information system.

✅ We charge a commission only on successfully approved amounts – no hidden fees!

✅ Once the contract is signed, you receive unlimited access to our client information system.

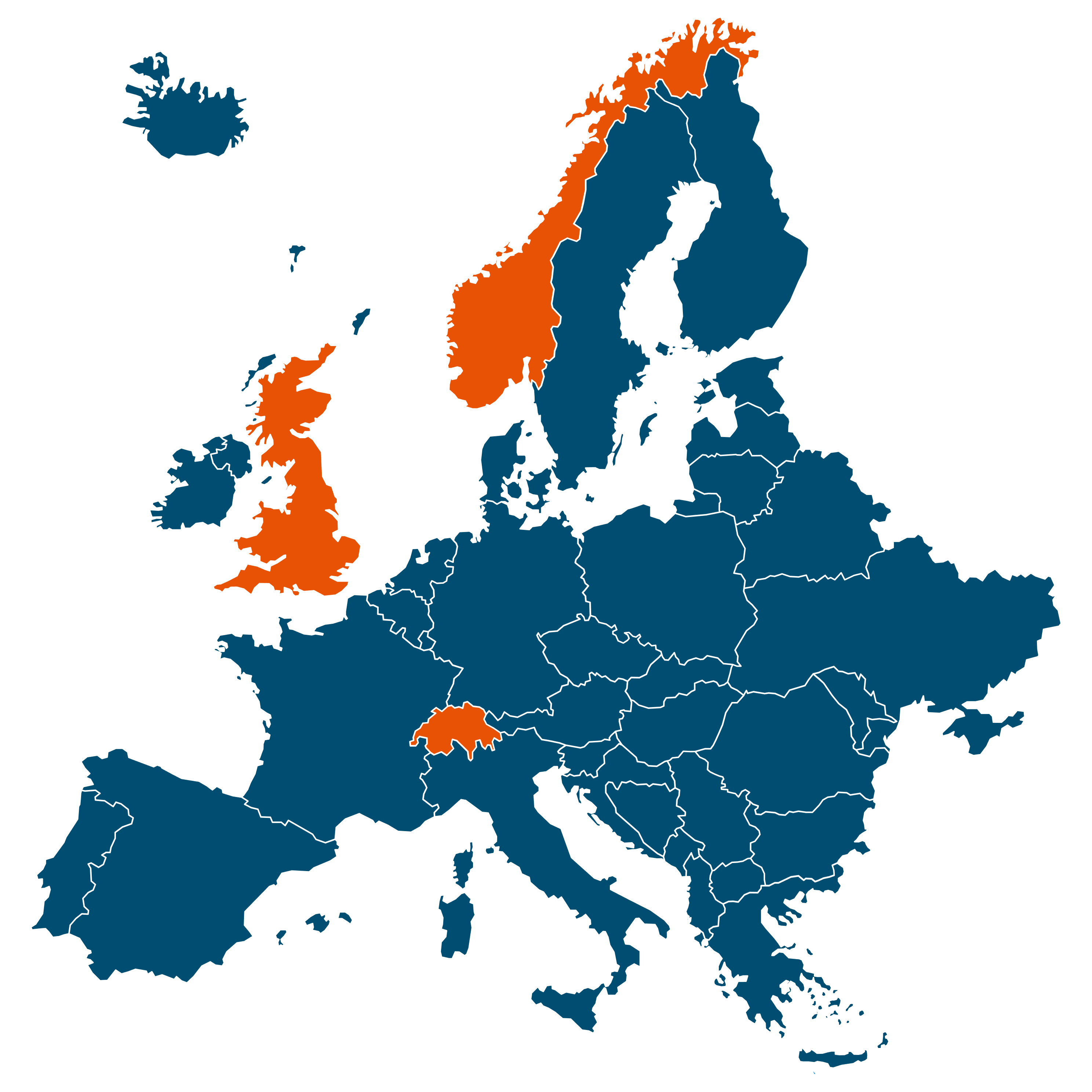

We provide services in all European Union countries, including the United Kingdom, Switzerland, and Norway. Thanks to our international expertise, we have a deep understanding of the tax systems and regulatory requirements in each country.

Why choose us?

- Registered with the Chamber of Tax Advisers of the Czech Republic – ensuring professionalism and legal compliance.

- Over 18 years of experience – we know our business and operate efficiently.

- Use of modern technology – cloud storage and digital document processing.

- Full transparency – our tax information system offers real-time access to all applications.

- We work with transport companies of all sizes – from small operators to multinational corporations.

- Fair conditions – commission only on successfully approved amounts.

Why become our client?

2006

For over 15 years, we have successfully recovered VAT, excise taxes, and withholding taxes for businesses from every EU country where the law permits.

1700

More than 500,000 invoices processed annually.

500 000

Zpracujeme více než 500.000 účetních dokladů ročně.

Advanced Client Portal for Your Convenience

For over 15 years, we have successfully recovered VAT, excise taxes, and withholding taxes for businesses from every EU country where the law permits.

Contact

EUROVAT – ASISTANCE spol. s r. o.

Na Hrázi 1452

755 01 Vsetín

Česká Republika

Phone 1: +420 571 411 208

Phone 2: +420 571 411 227

Mobile 1: +420 775 571 033

Mobile 2: +420 777 571 127

E-mail: info@eurovat.info